Collections & Reconciliation for Buy Now Pay Later Businesses

Easy & transparent experience.

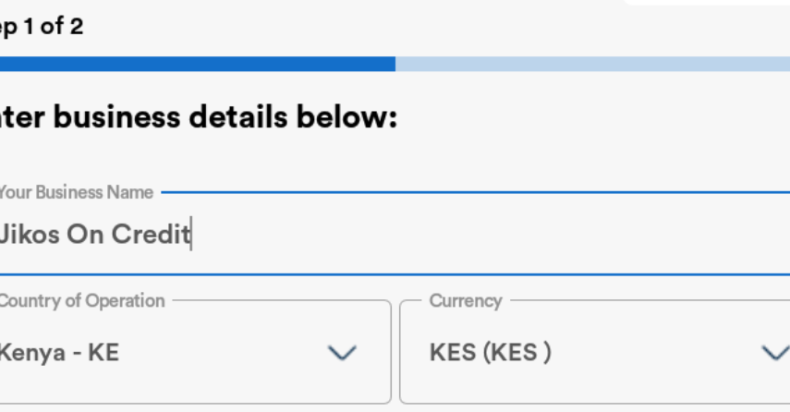

01. Set up your account

You can add as many BNPL products as you have, sell to as many customers as there are and add as many products as you have.

Your Business in Your Hand

Serving 1000+ customers daily? Manage collections for all from your handset device.Bank-grade security

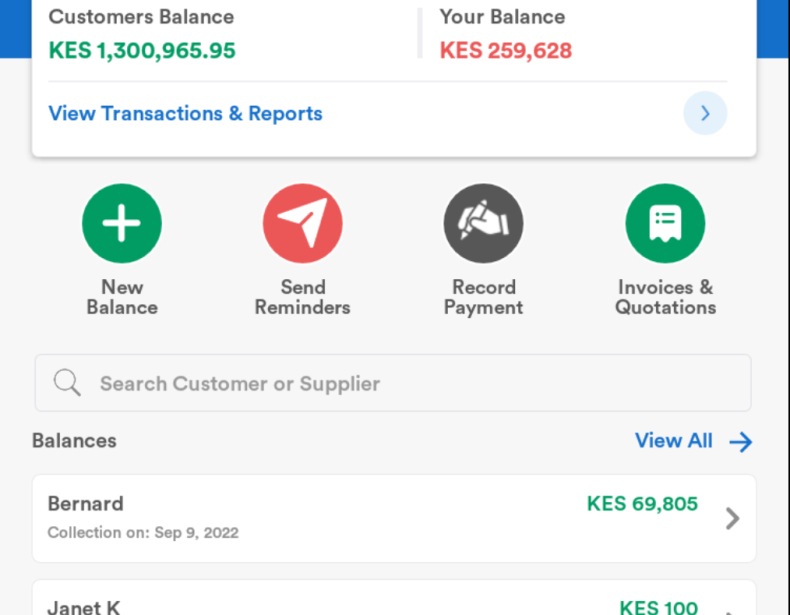

Your data, that of your tenants and your payments are only accessible by you. We care about your safety02. Manage Your Customers & Their Payments

Add customers and their credit sales including installment payment plans. Each customer automatically gets a payment account.

03. Leave the rest to us

We take over from here and automate everything. You worry about how to grow your business, we worry about you getting paid.

BNPL Selling

Create your credit sale, structure instalment payments and add customerAutomated Reminders

We send reminders periodically via SMS/WhatsApp/Email to your customers with their balances & payment details.

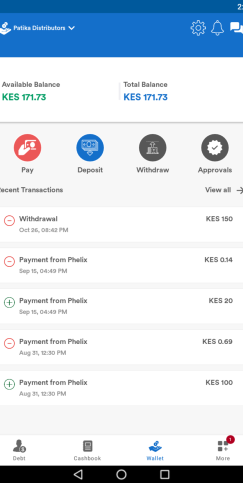

Payments Processing

Your customers pay directly to the accounts issued to them via Patika. They receive a receipt instantly.Automatic Reconciliation

Every payment is attributed and reconciled. No more manual recons with bank/mpesa statements.04. Lipa Mdogo Mdogo

You no longer have to restrict your customer to only make lumpsum payments by end of instalment period. With our automated payment flows, any part payment made by the customer is auto reconciled and money moved to your wallet. No more checking bank statements and mpesa statements manually to confirm payment receipts, losing 5 hours in the process.